VAT Changes for Building and Construction Services – Domestic Reverse Charge VAT

Following on from our previous blog on this matter, the Construction Industry Reverse Charge for VAT is due to come into effect on 1st March 2021.

This will affect VAT registered businesses who supply or receive services under the Construction Industry Scheme (CIS), that are subject to standard rated or zero-rated VAT.

If your invoice consists of a mixture of CIS and non-CIS supplies, the whole supply will be subject to the reverse charge (unless it falls within the “5% disregard”).

What is reverse charge?

The Domestic Reverse charge will move the responsibility of VAT collection to the contractor who supplies the end user.

Those further up the supply chain will apply the Domestic Reverse Charge VAT rate on their sales invoice to the contractor/customer, and the subcontractor will receive payment of the net amount.

The contractor/customer would then account for both the input and output VAT on their next VAT return.

Impact on cash flow

The introduction of the Domestic Reverse Charge may impact on cash flows in the following ways:

Subcontractors – cash flow may be negatively impacted as they will no longer be receiving VAT payments from their contractor/customer.

Contractors – will likely have a short-term cash flow benefit as they will not be paying VAT amounts to subcontractors. However, they will need to account for VAT as output tax as well as input tax on their VAT return.

What you need to do to be ready for the start of the domestic reverse charge

Both contractors and sub-contractors need to prepare for the 1 March 2021 introduction date by:

- check whether the reverse charge affects their sales, purchases or both

- making sure their accounting systems and software can deal with the reverse charge

- consider whether the change will have an impact on their cash flows

- making sure all their staff who are responsible for VAT accounting are familiar with the reverse charge and how it will operate

What contractors need to do

- Check if their supplier has a valid VAT number

- Tell their supplier if they’re an end-user or intermediary supplier, as the reverse charge will not apply

- Review the contracts they have with sub-contractors, to decide if the reverse charge will apply to these services. Notify their suppliers if it will

- Main contractors supplying standard or reduced rated supplies to end customers of the building and construction services would not apply the reverse charge. Here, VAT should be charged in the normal way

What sub-contractors need to do?

- Check if their customer has a valid VAT number and CIS registration

- Review their contracts to decide if the reverse charge will apply, and tell the customer if it does

- Ask their customer if they are an end-user or intermediary supplier

- As they’ll no longer receive VAT on their sales invoices they might find that they become a repayment trader with HMRC (a business that receives repayments from HMRC rather than making a payment from completing VAT returns.) Consider changing to monthly VAT returns to improve cash flow which will accelerate the repayment amounts.

What changes will need to be made to sales invoices?

Invoices will need to clearly state that the reverse charge applies using the correct and approved terminology. HMRC Suggests to businesses to use any of the following:

- Reverse charge: VAT Act 1994 Section 55A applies

- Reverse charge: S55A VATA 94 applies

- Reverse charge: Customer to pay the VAT to HMRC

It should be clear on the invoice that the reverse charge mechanism has been applied and it should show all the usual information required for a VAT invoice.

Invoice example –

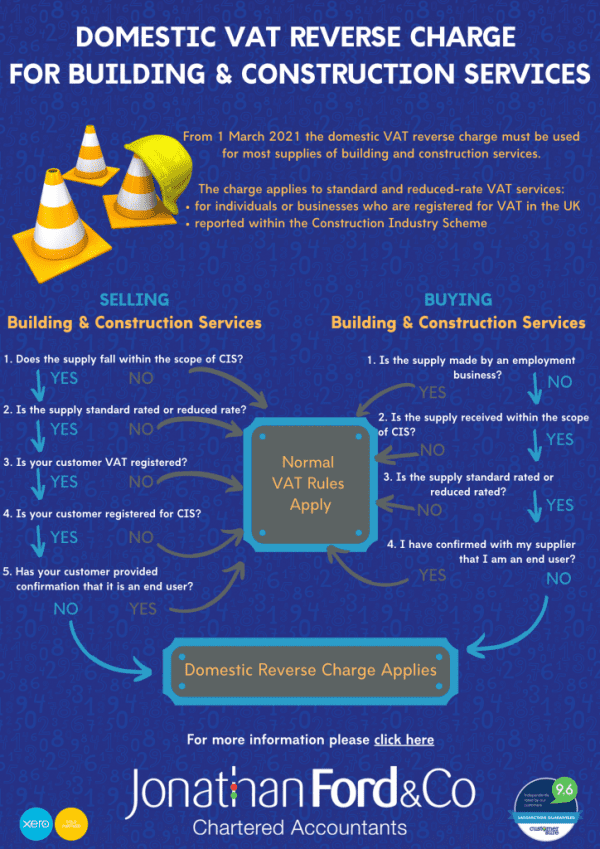

Download our Domestic VAT Reverse Charge Flow Chart

Use these flowcharts to help you decide if you need to use the reverse charge.

Domestic VAT Reverse Charge Flow Chart pdf

For more information, please refer to HMRC’s VAT Reverse Charge Technical Guide – https://www.gov.uk/guidance/vat-reverse-charge-technical-guide