Does a company director need to complete a tax return?

The good news? No – a director whose income consists only of PAYE earnings and dividends chargeable at the ordinary rate or lower is under no obligation to notify HMRC of their chargeability to income tax.

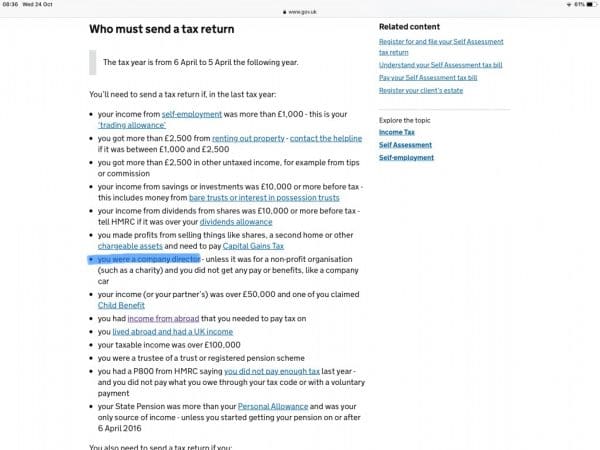

The bad news? The law (Section 7 Taxes Management Act 1970) and HMRC differ on this. Take a look at HMRC’s guidance below:

The incorrect guidance that HMRC use can mean tax payers are badly advised by HMRC front line staff – and even fined for late submission of tax returns that they did not need to complete. Even more worryingly HMRC have stuck to their guns when tax payers have appealed and cases have gone before the Courts.

Fortunately, judges do know the law on this matter and have been scathing about HMRC.

“I consider that the material on the GOV.UK website is wrong and should be removed. No one should be expected to make themselves aware of what is not a correct statement of the law” Judge Richard Thomas

Many directors will have other factors – such as taxable dividends or rental properties – that mean they need to complete a return so care needs to be taken.

But, simply being a director of a limited company isn’t enough for you to need to notify HMRC that you need to complete a tax return – whatever HMRC might say.