Should I pay my pension contribution through my company?

What is more beneficial? Paying your pension yourself or paying it through your limited company?

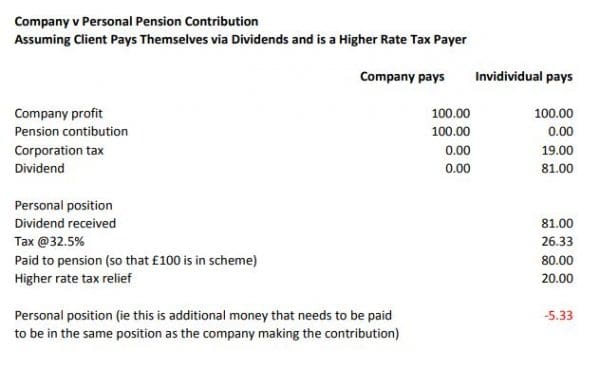

The example above shows that for a higher rate tax payer it is better for the company to pay. In this example the individual would need to find another £5.33 per £100 to be in the same position as if the company had paid.

For a basic rate tax payer it is still advantageous for the company to pay although the amount falls a little to £5.08.